Changing Table Ordering

Shift columns: with the mouse grab the column header and drag to new position.

Special Situations

Users should be aware of special cases that may require manual adjustments of results generated by SkedDee before they are transposed to Schedule D.

-

The disposition of inherited property is always reported as long-term, even if the decedent acquired the property in the year of sale. Input the transaction with a date suitably in the past to force the transaction to be long-term. On Schedule D, enter “Inherited” for the acquisition date

-

SkedDee assumes short sales are short-term. If the asset delivered to cover the borrowed asset has been held for more than a year, however, the gain or loss is long-term

-

SkedDee will detect a fractional share as a result of a split, but the user must supply the proceeds information and enter the resultant sale

For details see “Further Information”.

|

Example Huey Lim has always liked technology shares, but finds the record keeping for tax purposes especially onerous because of their frequent share adjustments. In 2008 he sold shares in Cisco, Microsoft, and ADC Telecommunications. He purchased shares of ADC in 1998, 1999, and 2000 and sold shares in 2000. In June 2008 his account statement said that he held 485 shares from which he proceeded sell 200. In addition, ADC had two splits (each 2:1) in 2000 and a reverse split (1:7) in 2005. He made purchases of Cisco in 1999 and sold shares in 2000 and 2008. Cisco had splits in 1999 and 2000. He enters his trade history for the three companies as follows: b 500 adct "ADC Telecommunications" 6/23/1998 16315 b 500 adct "ADC Telecommunications" 7/16/1999 23315 x 2 adct "ADC Telecommunications" 2/16/2000 0 b 200 adct "ADC Telecommunications" 4/3/2000 10112 x 2 adct "ADC Telecommunications" 7/18/2000 0 s 1000 adct "ADC Telecommunications" 7/24/2000 44000 x 1:7 adct "ADC Telecommunications" 5/10/2005 0 s 200 adct "ADC Telecommunications" 6/9/2008 3394 b 300 csco Cisco 1/25/1999 31032 b 200 csco Cisco 4/6/1999 23050 s 400 csco Cisco 2/4/2000 48452 s 400 csco Cisco 6/9/2008 11095 x 2 csco Cisco 6/22/1999 0 x 2 csco Cisco 3/23/2000 0 b 400 msft Microsoft 12/5/86 19650 x 288:1 msft Microsoft 1/1/2000 0 s 800 msft Microsoft 6/9/2008 22168

He doesn’t know exactly the dates of all the splits in Microsoft stock, but since he hasn’t had any trade activity since his original purchase, soon after the IPO, and knows the stock’s adjustment factor is 288, it’s sufficient to enter a single split record at an arbitrary date between his original purchase and the sell. He processes the transactions. The reverse split of ADCT results in a sale of a fractional share. SkedDee tells him to enter a sale in the form: S 0.7143 adct "ADC Telecommunications" 05/10/05 xx.xx where xx.xx is the proceeds of the sale. He could get this from his broker’s statement, which is filed away, but because this is a small amount and because he’s at his PC he gets the closing price on 5/10/2005 of $16.70 (unadjusted). He enters @16.7 as the per share proceeds and lets SkedDee perform the extension (16.7 x 0.7143). He enters the sale for the fractional share and presses Process. The matched trades tab shows that the last 4 lines (the Description through Profit/Loss columns) are to be entered in Part II (Long-Term Capital Gains) of his Schedule D:

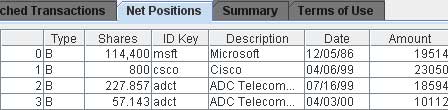

The sale of 200 shares on 06/09/08 is decomposed into two lines to enable the user to follow the allocations. A portion of the cost basis (142.14) came from the shares purchased on 6/23/98 and the other portion (57.9) came from those purchased on 7/16/99. On the Schedule D, however, it would appear as a single line entry: “200 shrs ADCT Various 06/09/08 3,394 12,838 (9,444)”. The only trade that actually was of a fractional share was the one on 5/10/05, which was the result of the reverse split. The highlighted area are trades that will be reported on his 2008 Schedule D. Similarly, the sums of each security in the Net Positions tab add up to whole numbers. The sale of the fractional share ensures this. He still holds 385 shares of ADC:

(That’s a comma, not a decimal point, in the holdings of Microsoft.) The summary tab shows that the net proceeds amount that should show in line 10 of Schedule D is $36,657. For 2008, if he has no other trades, he will show a net long-term gain of $13,339.

|