Sources of Information

A primary source of information to SkedDee is the 1099-B, which every broker is required to send at the end of each tax year. An alternative source for input would be the confirms sent after each trade. It is possible that the user’s 1099-B will not include purchase information. This may be retrieved from the broker's periodic account reports. Some brokers provide the 1099-B information on Excel worksheets, which would be the most convenient way of providing input to SkedDee. Many brokers also provide complete trade history online, which can be copied and pasted into the user’s spreadsheet program.

There are several ways of providing input to SkedDee:

-

Typing the trades directly into the input box

-

Maintaining the trades in a text editor, such as WordPad, and transferring the text by using copy and paste

-

Some brokers provide trade history online in the form of spreadsheet files, such as Microsoft Excel™. These may be transferred to SkedDee by using copy and paste

-

For large volumes of trades, using a flatbed scanner with optical character recognition (OCR) software into a program such as Excel

Moving Trade Input from Excel to SkedDee

To insure security, well-behaved browser programs do not and cannot access resources outside the browser. This includes user files and the clipboard. Therefore to move data past the security barrier requires intervention by the user.

Step 1.

Assuming the trades are entered in Excel (don’t forget, names with embedded blanks must be surrounded with quotation marks), select the area containing the trades:

Copy to the clipboard.

Step 2.

Paste the trades into the Input box of SkedDee.

|

Example

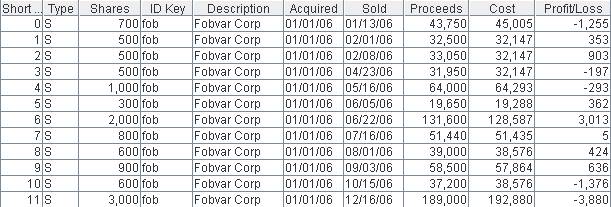

During 2006 Alejandro Kos actively traded in the shares of Fobvar Corporation. For all his effort, though, he actually lost about a thousand dollars. So when it came time to prepare his 2006 income taxes he figured he could save himself and the IRS effort by not filing a Schedule D with his 1040, figuring they wouldn’t care because doing so would lower his taxes. But they did, and several days ago, to his great surprise he received a notice containing the IRS’s version of the absent Schedule D. Based on information received from his broker it noted that he had received $731,640 in proceeds from his sales, and, according to their calculations, he owes them $256,074 in back taxes plus $64,019 in interest and penalties. Brokers don’t tell the IRS is what the customers pay for the securities, thus sales are looked upon by the IRS as pure profit until taxpayers demonstrate otherwise on their Schedule Ds. The IRS allows Alejandro the alternatives of either agreeing and paying the $320,093 or disagreeing by filing his version of the Schedule D with the relevant trade costs. He decides to disagree and file the Schedule D. Now, given a gentle nudge from the IRS, he actually reads the manual for the Schedule D and learns that he didn’t have to go through the arduous process of matching each trade to previous buys. Since all the buys occurred in the last months of 2005 and though 2006 and were sold in 2006, all the transactions were all short-term. He could have saved some time by indicating that the buys were at “Various” dates on the Schedule D. He enters the following trades into SkedDee:

b 11400 fob "Fobvar

Corp" 1/1/2006 732945 (Aggregates one year’s purchases starting

11/5/2005)

The resulting Matched Transactions tab appears as

After copying and pasting the results in the Matched Transactions tab back into his spreadsheet version of Schedule D, Alejandro substitutes the word “Various” for the date 1/1/2006.

Keep in mind that the IRS checks the yearly total proceeds amounts reported by the broker against what the individual reports on his Schedule D (lines 3 and 10) to confirm tax compliance. |