Buys and Sells Entry Format

Each line entry has 6 data items separated by one or more spaces:

Trade type, units (number of shares), ID, description, date of trade, dollar amount

Where:

| Trade type | is ‘b’ or ‘s’ for buy or sell |

| units | is the number of units of the security |

| ID | is a user assigned security identifier, e.g. IBM, GOOG, AXP, etc., composed only of alphabetic and numeric characters. The first character must be alpha. If the CUSIP is used, prefix it with an alpha character. This identifier is used as the key to match transactions with positions |

| description | is descriptive text. It is provided for the user in identifying the security and is not used by the program. If it contains one or more embedded blanks, it must be enclosed by quotation marks |

| date of trade | is the trade date in the form mm/dd/yy or mm/dd/yyyy. The year portion must have at least two characters |

|

dollar amount -or- @per share amount |

is the dollar amount. For a buy it is the net purchase price. For a sale it is the net proceeds. These amounts should include broker commissions. If source documentation is not available, specify the per share price on the day of the transaction and prefix it with an ‘@’ to obtain an estimate. The net amount is calculated by SkedDee by multiplying the per share amount by units. The ‘@’ form would also be used to report sales of mutual funds which report basis as an average cost |

|

Examples s 100 ibm “IBM Corp” 6/23/98 @111.75 (sold 100 shrs of IBM for $111.75/share) |

Share Exchange Entry Format

For exchanges (splits) the fields have the following format:

Trade type, new:old, ID, description, date of trade, 0

| Trade type |

is ‘x’ exchange (split of shares which can only be in whole units) or ‘xf’ exchange (split of shares which may be in fractional units, e.g. 100.2661, 65.5) |

| new:old | is the ratio of new shares exchanged for old shares in the form: new shares:old shares. If the colon and old shares are omitted, old shares is assumed to be 1. For example, 2:1 and 2 are synonymous. 1:3 means one new share for 3 old shares (a reverse split) |

| ID | is a user assigned security identifier, e.g. IBM, GOOG, AXP, etc., composed only of alphabetic and numeric characters. The first character must be alpha. If the CUSIP is used, prefix it with an alpha character. This identifier is used as the key to match transactions with positions |

| description | is descriptive text. It is provided for the user in identifying the security and is not used by the program. If it contains one or more embedded blanks, it must be enclosed by quotation marks |

| date of trade | is the record date of the exchange in the form mm/dd/yy or mm/dd/yyyy. The year portion must have at least two characters |

| zero | this field is reserved for future use |

|

Examples

x 2:1 leh "Lehman Brothers" 5/1/06 0 (a 2-for-1 split, date of record: 5/1/2006) x 1:4 java "Sun Microsystems Inc." 11/12/07 0 (a 1-for-4 reverse split)

|

|

Example

Oswald Kepper is preparing Schedule D for his 2007 tax return. Looking through his files he finds his confirms for his IBM trades and enters

b 500 ibm "IBM Corp" 7/2/96 50684 s 150 ibm "IBM Corp" 12/8/96 23685 X 2 ibm "IBM Corp" 5/28/97 0 b 200 ibm "IBM Corp" 1/26/98 19630 X 2 ibm "IBM Corp" 5/27/99 0 s 400 ibm "IBM Corp" 2/5/07 40152 s 700 ibm "IBM Corp" 11/1/07 79555

Oswald bought 500 shares and sold 150 shares in 1996. IBM split 2-for-1 in May 1997 and again in May 1999.

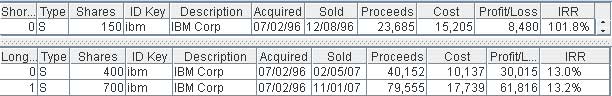

The Matched Transactions tab displays one short-term and two long-term transactions:

The Net Positions tab displays:

This tells him that his holdings of IBM should amount to 700 shares, 300 from his purchase in 1996 and 400 from 1998. If Oswald runs SkedDee the next year, the 2 positions in IBM may be entered as trades instead of re-entering all of the trades entered previously. He can copy the two rows, paste them in an Excel spreadsheet, and then save it. The positions have been split adjusted, so the splits should not be included the next time.

|

Some entities -- utilities, mutual funds -- have a policy of reinvesting dividends and allow holdings of fractional shares (e.g. 100.6198 shares, 20.5 shares). Use the ‘XF’ form to indicate a split of this type of security.